These trends must be paid attention to in 2023, when the packaging and printing industry’s ability to resist recession will be tested

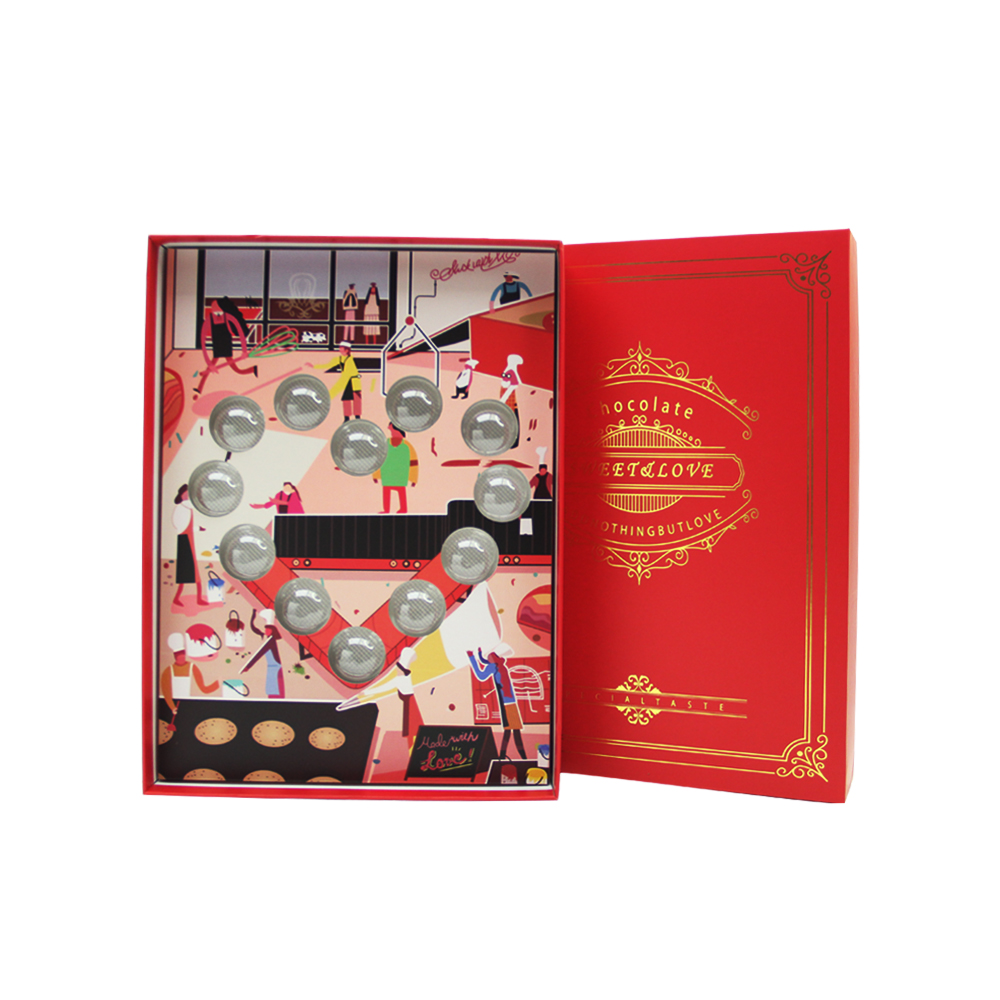

M&A activity in the packaging and printing sector will increase significantly in 2022, despite a decline in broader middle market deal volume. The growth in M&A activity is mainly attributed to several key factors – the resilience and stability of the packaging printing industry, the rise of e-commerce driving an increase in demand for packaging printing solutions, the continued expansion of global trade and the growth of emerging markets.chocolate box near me

A few days ago, Scott Daspin, director of investment banking at Triad Securities, and Paul Marino, head of Sadis & Goldberg’s private equity group, shared their professional knowledge and insights on the past, current situation and prospects of the packaging and printing industry.

Both have extensive industry knowledge and experience, with Daspin having a rich history of developing new relationships and identifying and closing successful transactions, while Marino focuses on the practice in financial services, corporate law and corporate finance and provides information on industry trends, Valuable perspectives on the packaging and printing industry, its impact on future M&A activity, and more.chocolate chip cookies box

Private equity will account for nearly 54% of packaging and printing transactions in 2022. Why?

Marino: Given the continued importance of packaging printing, it is no surprise that capital has been attracted to this industry. Many middle-market operators are family-owned, which helps improve efficiency. Investors recognize the value and growth potential of an industry serving a wide range of industries, from food and beverages to consumer goods and pharmaceuticals.chocolate fundraiser boxes

Are there any strategies used by private equity firms to create value and achieve growth?

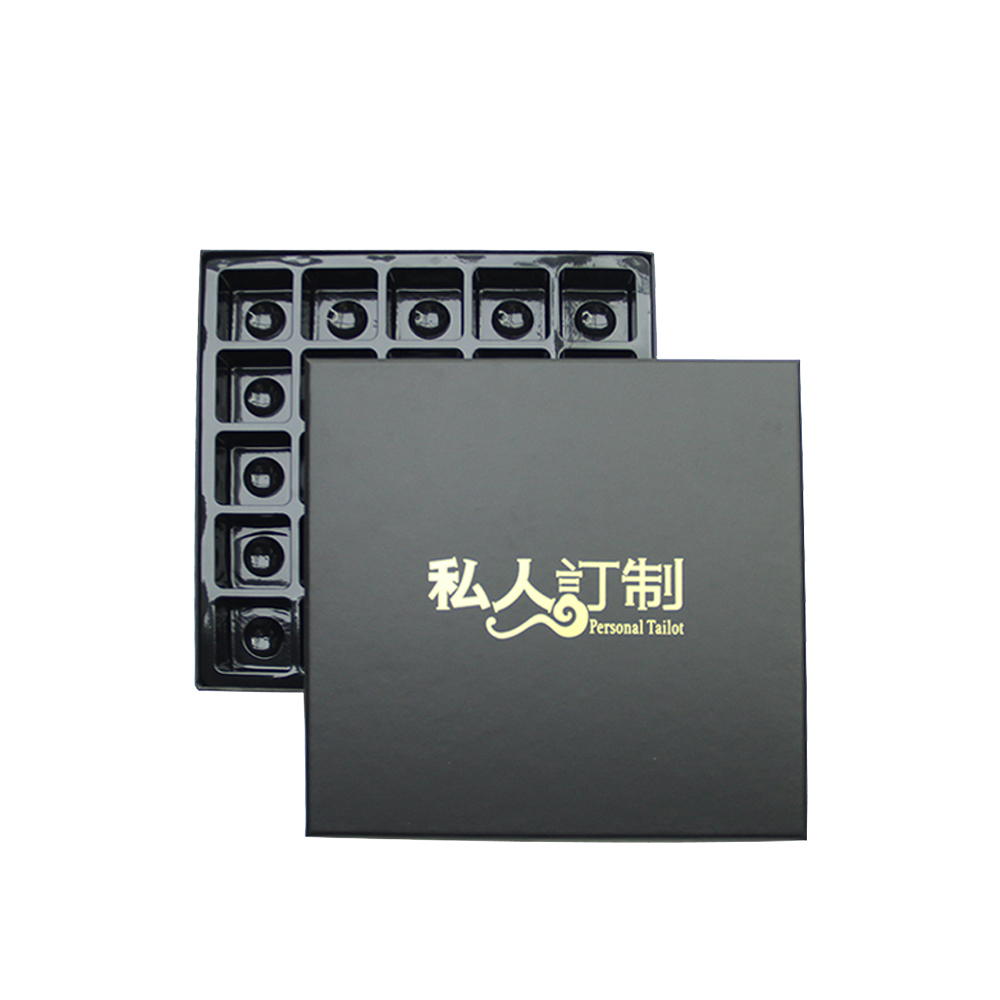

Daspin: Private equity firms are making their mark on the packaging printing industry by using a ‘buy and build’ strategy. This involves acquiring a portfolio of companies in the same or related industries and then consolidating and merging them to create a larger, more efficient and competitive business. Due to the decentralized nature of the packaging and printing industry, there are many small and medium-sized enterprises, and there are fewer large-scale enterprises. Investors can acquire multiple companies and integrate them to achieve greater economies of scale, reduce costs, and generate higher profits. .chocolate lab boxer mix

In 2023, the anti-recession concept of the packaging and printing industry will be tested. What are the trends worthy of attention?christmas chocolate box

Marino: Newton’s third law of motion states that “for every action, there is an equal and opposite reaction.” This concept is similar to the business cycle. Over the past two years, pandemic exuberance has been balanced by a deeply pessimistic outlook for 2023.

However, macroeconomic uncertainty is likely to have a significant impact on the packaging industry in the coming year. Given ongoing political tensions, shifting global trade policy, and an uncertain economic outlook, many companies may choose to delay investment and reduce spending on packaging. This may lead to slower demand for packaging materials, affecting the growth of the industry. Additionally, if businesses start to be cautious with their budgets, they may turn to cost-saving packaging solutions, which may challenge the innovation and development of new packaging printing technologies.christmas chocolate boxes

However, history suggests that the packaging and printing industry should remain resilient. The rapid growth of e-commerce and the resulting increase in home delivery will drive the demand for innovative packaging solutions that protect and preserve products during transit.

Additionally, as consumers become more aware of the environmental impact of packaging, the demand for sustainable packaging materials and solutions will grow. The continued expansion of global trade and the growth of emerging markets will create new opportunities for the packaging industry to serve a wider range of customers and industries.dark chocolate box

Do some of the deals you have been involved in in the past year have anything in common?

Daspin: Most of my packaging printing deals involve family businesses that are both profitable and financially self-reliant. The typical homeowner is either looking for a way to transition into retirement or simply looking for an opportunity to cash in, and sellers typically have 85% or more of their net worth tied to their business.forest gump box of chocolates

Interestingly, the highest bidder is not always the best solution: Sellers often prioritize working with buyers who will keep the company afloat after the sale. For example, sellers will often reject higher initial bids from financial buyers, preferring to work with private equity-backed strategic buyers who offer less competitive valuations but the opportunity to reinvest some of their equity and remain actively involved Companies, with a path to succession planning. As a result, most of my time in the deal was spent trying to match the seller’s desired outcome with the buyer’s desired outcome that met those criteria.godiva boxed chocolates

In 2022, the trend of more U.S. states enacting extended producer responsibility laws continues. What are these laws and what they mean for package printing companies?

Marino: Following actions taken by counterparts in Oregon and Maine in 2021, lawmakers in California and Colorado enacted EPR laws designed to help reduce waste from packaging and containers. These bills, while not identical, require large producers of packaging and containers to cover the costs associated with collecting and disposing of their products. Additionally, they have set goals to encourage producers to use more sustainable packaging and materials. Most of the new laws also require companies to provide information on the recyclability of their packaging and provide collection systems for recycling packaging.large box of chocolates

What advice do you have for potential sellers after the transaction closes?

Daspin: Mainly making sure they understand their future role in the company and their responsibilities to buyers. Some business owners may have never worked for anyone before, so it may take them some time to learn about new corporate structures or reporting requirements. Also, since company employees often don’t know about a deal until it’s closed, I recommend that they take the time to understand how the outcome of the sale will affect their employees.

They should also know how to communicate with suppliers and customers after the transaction. A successful trend I’ve seen is extending announcements by 20-30 days so sellers can get their message across before their stakeholders hear it from other sources. I think it’s important to understand what your message is and what you can say to your employees, customers and suppliers.

Are there any legal issues that must be negotiated in a successful acquisition or sale of a packaging printing company?

Marino: The buying and selling of a business is the most important transaction a business owner can make, rivaled only by initial organization or liquidation. All players involved in financial and legal due diligence have changed dramatically, giving these deals their own drama and complexity. While not specific to packaging exchanges, some items, such as customer, supplier and employee contracts, deserve more scrutiny in the process of buying a packaging company.

Post time: Jun-13-2023